(Enjoy this free copy of On the Street. This friendly reminder: My Red Flag Alerts and selected On the Street content are no longer free. But while the paint is still drying on my paywall, my introductory price remains. I will be raising prices. Here’s more on my decision to go paid, and what to expect from my Red Flag Alerts.)

As long as I’ve been a journalist, three things are as true today as when I first started...

I still get palpitations when whatever I write is published.

It’s still nice to see my work mentioned... and On the Street got two mentions this past week. Both were by market strategists I respect, who were using something I wrote to help make a much bigger point.

I’m a sucker for common sense.

‘Corrupted’ Jobs Numbers

The first On the Street mention was by the inimitable Michael Green, whose weekly Yes I Give a Fig on Substack never takes the easy way out. In his Uber Alles piece last week, he used my comments on Tupperware’s bankruptcy to make a point: that the gig economy, as his sub-headline put it, “sits at the heart of an impending scandal on government reporting”

It’s a fascinatingly intense report that suggests unemployment is, in effect, “leading to a misleadingly optimistic portrayal of the economic landscape.”

Other than to say that government economic numbers have been suspect for as long as I can remember, especially in election years, I’m not going to weigh in on this specific issue. Not only is it well beyond my pay grade, but the way Mike untangles and interprets it is also well beyond the analytical limits of my brain.

What isn’t overly complex, though, is the below chart Mike put together, which is brilliant in its simplicity... overlaying Tupperware’s stock chart with the emergence of the app-based gig economy, featuring the likes of Uber....

As I wrote in my piece...

The Trouble was, Tupperware was trying to sell via parties and a creaky multi-level-marketing business model while facing increased competition at retail from the likes of Newell Brands' $NWL Rubbermaid, Clorox's $CLX Glad, and Helen of Troy's $HELE Oxo brand, among many others that are cheaper and more readily available.

But for a direct seller like Tupperware, even more worrisome: beyond the competition of selling products there was also competition for salespeople. That was especially tough in the "gig economy,” given the rise of companies like Uber $UBER , DoorDash $DASH , and Lyft $LYFT , but also continued competition from other direct sellers... including the Pampered Chef, Perfectly Posh, and Stella and Dot.

Trust me when I say, Mike takes it to another level. See for yourself.

Speculative Markets

From ‘corrupted’ economic data to speculative markets...

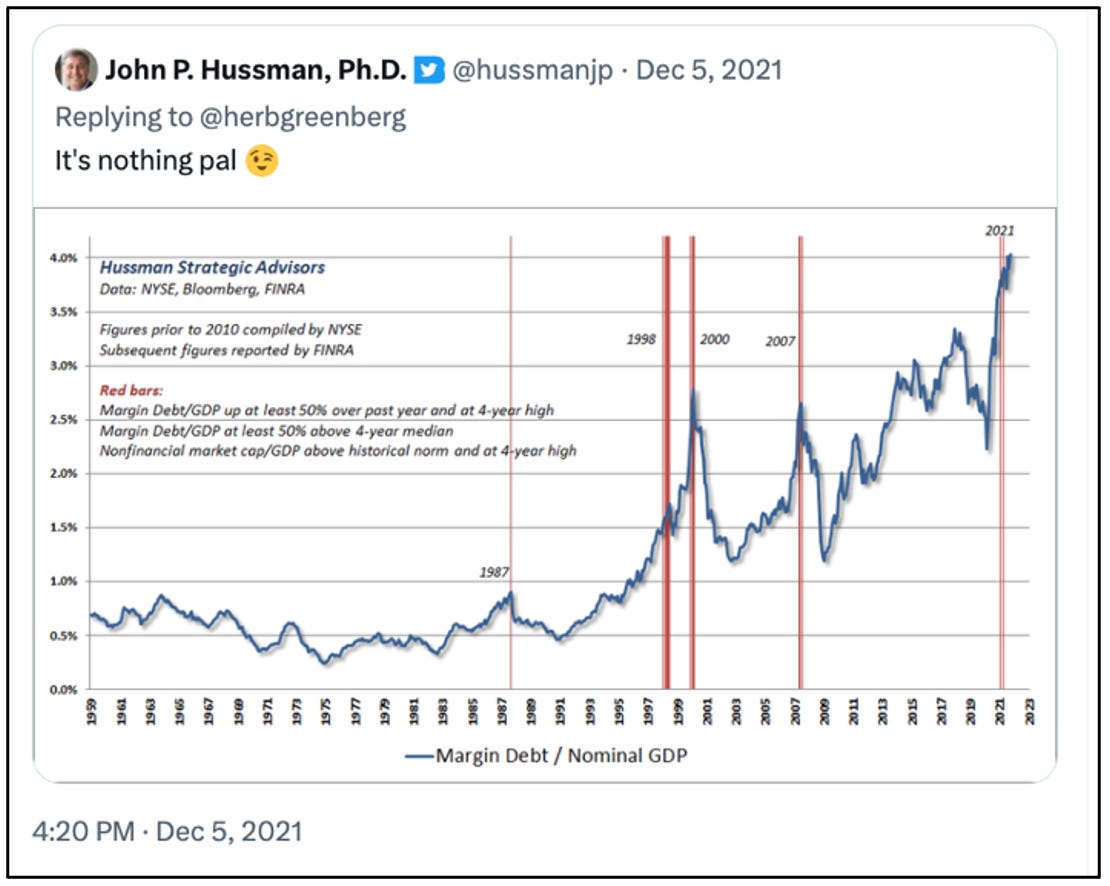

The second On the Street mention was by John Hussman in his latest monthly market commentary. John runs the Hussman Funds, and for some reason he can spark a stock market street fight like nobody else I know – a testament to his independence and original research and thought.

I first started quoting John in the early 1990s in my Business Insider column in the San Francisco Chronicle... when nobody knew who he was.

We reconnected in 2021, after I tweeted a chart of skyrocketing brokerage margin.

John responded with a chart of his own...

Enter his latest comment...

Herb Greenberg, who’s still writing, and has an interesting and useful column On The Street on Substack, shared this note a few weeks before the January 2022 peak:

And he included the below....

That’s right, he was a resident bull.

Like so many others, John was bullish until the dot-com bubble started to grow bigger... and bigger... and bigger, on its way to becoming enormous. But like the others, he was clearly stumped by the band. Or as was the case at the time, the almost out-of-nowhere rise of momentum investing, which for a time appeared to render all traditional technical and valuation analysis useless. (At least that’s my perception.)

That dynamic has since been supercharged, I would argue, by quantitative, computer-driven investing combined with the growing dominance of ETFs and passive investing.

Which gets us to where we are today. John regards this period as the “third great speculative bubble,” whose hallmark he believe is “the greatest concentration of market capitalization in speculative glamour stocks since the peaks of the other two bubbles in 1929 and 2000.”

What’s an investor to do? As John wrote (emphasis by me)...

Nothing in the current motherlode of market extremes ensures that the market has hit a peak, or that stocks can’t register further highs. I generally don’t have a forecast about near term outcomes, and I don’t have one here.

I do believe long-term, full-cycle market prospects are dismal, and that present conditions warrant a bearish market outlook.

Even so, our long-term investment stance will be made of no other substance than the series of investment stances that we adopt from one week to the next, in response to the conditions we observe at each point.

I only know the present stance for certain.

Our next outlook seems more likely to be a neutral outlook than a constructive one, but we’ll take the evidence as it comes. In short, our investment discipline is to identify prevailing, observable market conditions, and align our investment outlook with the expected return/risk profiles that we associate with those conditions.

Which makes sense, because nobody can see the future, certainly not clearly... and certainly less clearly than 20 years ago – before the computers and passives took hold.

Still, here’s what I’d like to know – something I need to ask John: what did he learn from being bearish so early in the dot-com bubble? Especially since it was relatively early in his career.

I’m assuming he’ll say he became more flexible, and based on his above comment, less definitive about the timing of any bubble’s burst. (John, amirite?)

You can read his full monthly commentary here.

Simple Common Sense

Reality is, everybody has their own approach to the markets...

On one hand there are the likes of Mike Green (Wharton grad and chief strategist for Simplify Asset Management, who used to manage macro strategies for Peter Thiel’s family office) and John Hussman (Ph.D. in economics from Stanford).

On the other, there are guys like Bob Howard, who lives on a bunch of acres in the Ozarks and for 32 years has written the Positive Patterns newsletter, which has no website and relies on word of mouth. Earlier this year I wrote about Bob in a piece I headlined, “A Common Sense Approach to Investing.”

Bob is an old-school former stockbroker, who went to Pt. Loma College, where he jokes on his LinkedIn that he majored in “ponies, betting patterns, real estate trends, avoiding social climbers.” Like Hussman, I used to quote him back at The Chronicle.

He was then and still is a go-to for a stock market sanity check – and in plain English, no less.

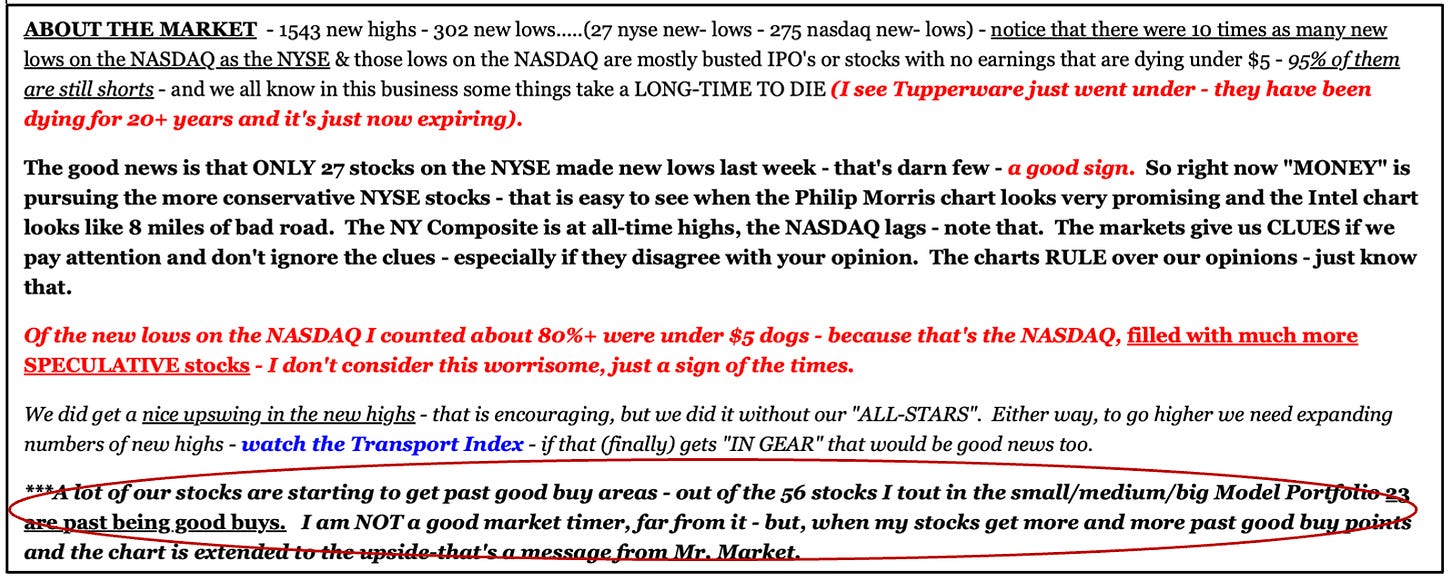

Let’s just say Bob doesn’t get caught up in the intricacies of trying to pull apart the market’s wet yarn. He just know what he sees, and still relies on has worked for him over the decades. In his latest report this week, when it turned to the market, he wrote...

It’s that last paragraph that got my attention, in particular...

I am NOT a good market timer, far from it - but, when my stocks get more and more past good buy points and the chart is extended to the upside-that's a message from Mr. Market.

I don’t think John or even Mike would disagree with that one. That’s because… it’s just common sense.

P.S.: As John said, yes – I’m “still writing” and hopefully like John, you find my work “interesting and useful.” If you do – and if you liked this – please don’t forget to click the heart below and share it with your friends.

More importantly, if you find that my Red Flag Alerts and On The Street content add value, please consider becoming a fully-paid subscriber.

Thank you.

Herb

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

I can be reached at herb@herbgreenberg.com.