What a Flawed Business Model Looks Like

Look no further than this bitcoin miner

You know a company may be in trouble when it starts spending a lot of time talking about things unrelated to its core business...

Like a bitcoin miner talking about shrimp farming.

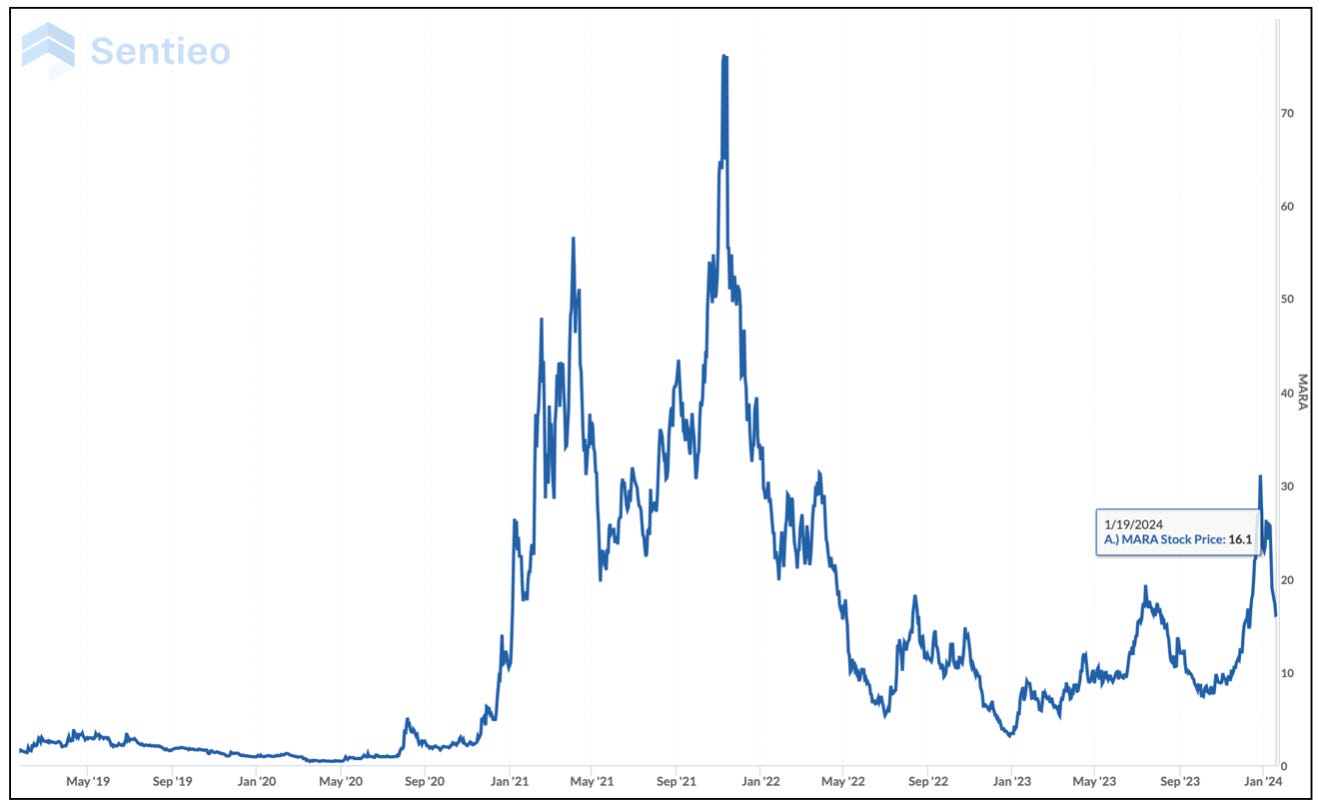

That’s exactly what’s happening with bitcoin miner Marathon Digital (Mara), the largest of all bitcoin miners, whose shares have plunged roughly 40% since I first red-flagged it two weeks ago.

Not that any of this should really be surprising.

Regardless of what you may think of cryptocurrencies, bitcoin mining is real. But as a credibly sustainable business model and even more – as an investment – it was flawed from the start.

The only reason it exists in a publicly tradable form is as another way to invest in bitcoin.

Now that there are bitcoin ETFs, that’s gone.

Running Up a Down Escalator

If that weren’t enough… unlike most businesses, which get easier as they scale up, the opposite is true with bitcoin miners.

They’re the ultimate in what I like to call a “running up the down escalator” business model…

That’s because of something called “halving,” a phenomena unique to bitcoin miners. It happens every four years, and each time it’s harder and harder to make money.

Bitcoin miners generate revenue two ways: Transaction fees and so-called “rewards” they receive – in the mining process – in the form of bitcoin.

At each halving, those rewards (not the fees) are cut in half. The next halving is in April, where the reward for mining a bitcoin gets cut in half while expenses remain the same. The best Marathon can hope for is that it can capture a greater percentage of transaction fees if other miners exit the market, which may very well happen. Even then, it like won’t be nearly enough to make up the difference from the halving… barring a bitcoin rally like the old days.

If that weren’t enough, there’s also a gyroscopic nature of this business model: While everything else is going on, the viability of the business hinges, unpredictably, on the price of bitcoin. As Marathon says in its 10-K...

Our business is heavily dependent on the price of bitcoin.

Look no further than its balance sheet, which is loaded with nearly $300 million in bitcoin – nearly triple the amount of cash.

Changing the Narrative

Which brings us back to shrimp farming.

With the halving on the horizon, like all other miners Marathon needs to lower costs.

That’s not easy, so it’s changing the narrative…

Bitcoin mining is still the star of the show, but management is starting to talk about “transitioning” the business model, with a focus on the long-term… especially novel ways to lower costs.

One focus is tapping into methane gas at landfills as an alternative source of power.

It’s also talking about diversifying its revenue stream by “monetizing heat take-off.” In other words, repurposing wasted energy from bitcoin mining and using it for none other than… shrimp farming.

“We don't intend to be in shrimp farming business,” CFO Salman Khan said at the Needham Growth Conference last week, “but it's a byproduct that can reduce our costs and increase our revenues and solve the problem for our stockholders.”

There’s a Catch

This all sounds good on paper, until you realize these are all pilot projects that may never amount to anything. In fact, the company went from saying in its May 10-Q it “will… seek to be involved” in renewable energy and methane gas projects to saying it “may… become involved” the very next quarter.

As nuanced as that is, it is important because it shows just how speculative it is.

The truth is, landfill methane recovery isn’t exactly a new idea and, in fact, is fairly competitive.

And as for funneling excess energy into shrimp farming, or heating greenhouses (they mentioned that, too, as well as “other forms of low-grade industrial heat processes”) – it’s all easier said than done.

Khan conceded as much in response to a question at the conference when he said...

This is a difficult problem to solve. It's not an easy one. Otherwise, anyone would have solved it.

But talking about shrimp farming and landfills helps shift the narrative and divert attention away from the reality that bitcoin mining is nothing if not a commodity.

So much so, in fact, that Marathon has never earned a dime from operations. Not that it can’t, or maybe even will, in the quarter about to be released. But then the question will be, what will they do for an encore after the halving?

Bottom of the Barrel

Not surprisingly, Marathon ranks horribly in overall financial statement quality. As of January it came in dead last among all companies in all industries, ranking 1,555 out of 1,555 small/midcap companies as scored quantitatively by my pals at Kailash Concepts. Worse, its manipulator score was 99%. (The higher the score, the lower the quality of the earnings.)

Even with the idiosyncrasies of bitcoin mining, that kind of ranking doesn’t generally bode well... and suggests that as an investment, Marathon’s stock will lag the market for at least a year.

On the plus side, the company cut its debt by half during the third quarter. It was able to accomplish that, in part by exchanging debt for stock. But to raise cash, it also issued more shares. That, in turn, diluted already-diluted investors even more by lowering their share of ownership in the company.

To their credit, this was a smart move by management, as it prepares for the likely havoc from the upcoming halving... but it was not good for investors.

Misleading Data

All of which gets back to Marathon’s stock and the wisdom of owning it now that there are bitcoin ETFs. Or as one analyst at the conference asked...

With an ETF out there, especially you guys were sitting on so much bitcoin do people say, ‘Okay, well now there's almost a pure play bitcoin trade out there I can do I don't need minor exposure and maybe ,in particular Marathon, which could be just kind of a big quite promising.

Khan responded (emphasis added)...

So I'd like to look at the data because data is king. Historically, last year, Bitcoin , if you had invested in Bitcoin, you would have gotten about 150% increase in your appreciation from January one through December 31... versus our stock, which went up 570% or so roughly. So there's that delta between Bitcoin and miners that that will always exist.

To which I say: Time out!

Data may be king, but when taken out of context, it’s also misleading... and it doesn’t get more misleading than this.

Marathon’s stock didn’t skyrocket the way it did because of underlying fundamentals. It shot higher because of a massive short squeeze, much like AMC and GameStop did during meme-stock mania.

That Khan even went there raises all sorts of red flags.

Not that it should be surprising...

After all, this is crypto, which has been known to create its own reality and live by its own rules.

Portraying a stock as a genuine out-performer, when it really wasn’t, is par for the course.

Marathon’s Next Act?

The ultimate question is what happens to Marathon?

Since it was incorporated in Nevada 14 years ago, it has had four names and has been in the uranium exploration business, the California home-flipping business, the patent licensing business (otherwise known as a patent troll) and now, bitcoin mining.

What’s next? If artificial intelligence continues on its hot streak, Marathon would seem to be a natural for hosting AI workloads.

If not, there’s always shrimp farming.

If you like this, please click the heart button, and don’t hesitate to share with your friends. Thanks!

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herb@herbgreenberg.com. You can follow me on Twitter (X) and Threads @herbgreenberg.

Great explanation of the impact of bitcoin halving on miners and the misrepresentations and various guises of Marathon Herb.

Thanks Herb. Hilarious and pathetic at the same time. Management should be hired by The Department of Defense as they are expert in the art of camouflage and deception.