Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

I don’t know much, but one thing I do know is that money doesn’t grow on trees...

It’s a simple concept most of us learned as kids – at least I did, since it was something my parents drummed into me.

I was thinking about it when another friend and I were going back-and-forth, wondering where retail investors – you know, everybody who doesn’t trade professionally – are getting all of the money that seems to be pouring into the stock market.

Rip-Roaring Retail Rally

This is a smart guy who used to run a tech-centric hedge fund. He does his own thing today because he can afford to, but even he’s scratching his head...

Retail continues to pile into stocks. I cannot figure out where they are getting the money.

During the selloff, they were piling in.

Apparently they are still piling in. I saw another data point a day or two ago that retail buying was so heavy, it was a 3-sigma event.

I cannot figure out where they are getting the money to do this. These people have been fully invested, and highly levered, for years. When you are fully invested, you cannot buy more. Heck, we saw it with the hedge funds/pods. They were fully invested, and did the opposite of buying the dip, because they were taking down exposure.

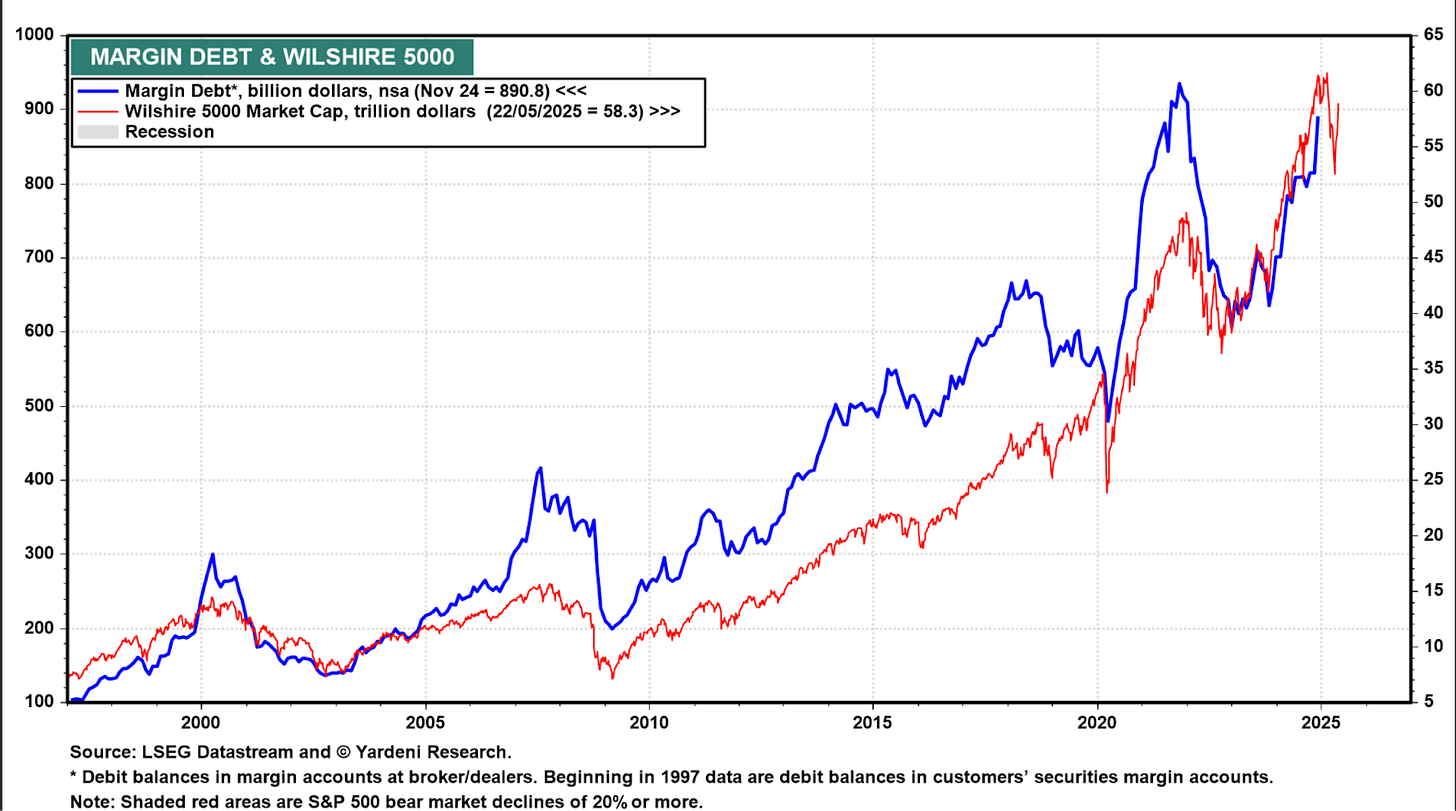

I figured the answer would be obvious in the latest brokerage margin numbers, such as this one from Yardeni Research... which is always a good indicator of investors getting full of themselves. And to some extent, while this isn’t fully up to date, it was...

Still, it doesn’t fully explain what’s going on, especially since so many of those investors likely had margin calls last time around... during the mangling of the market a month ago. When there’s a margin call, if stocks fall, investors who borrowed money from their broker to buy stock have to come up with more money – or sell their stocks.

Korean Capers

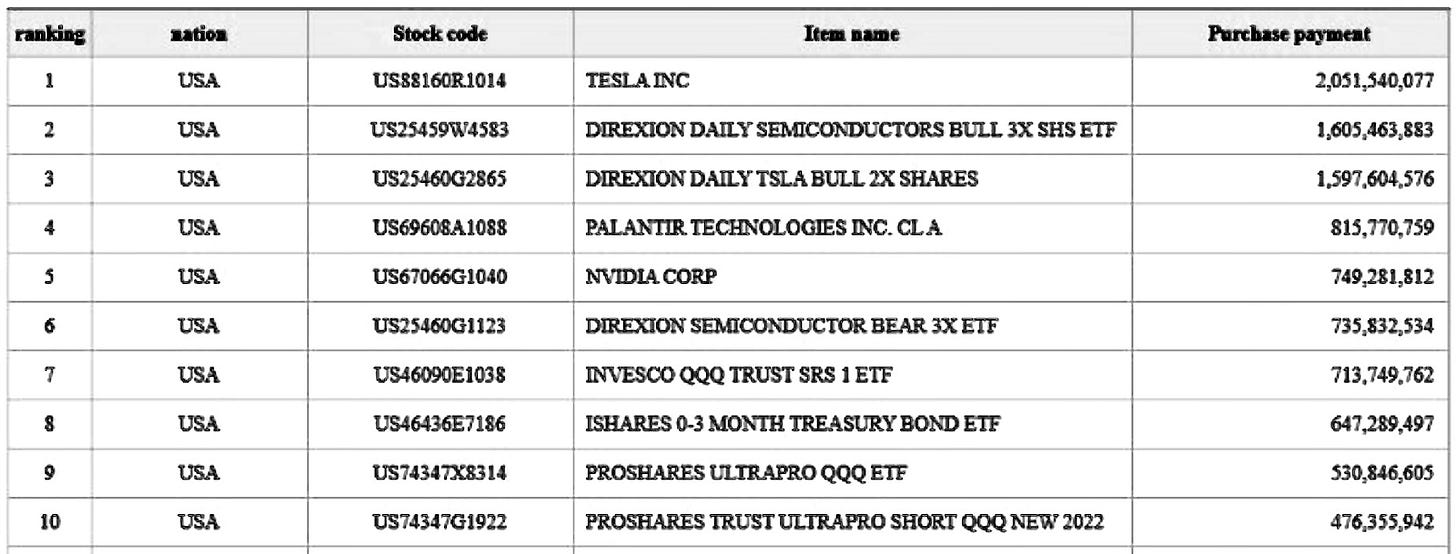

Then a friend sent me a table of the top 50 stocks purchased over the past month by Korean investors by dollar volume by Koreans. It’s from the Korea Securities Depository. I stopped after reading the Top 10...

As you can see, it’s top-heavy with the most speculative, multi-leveraged ETFs on the planet. These are ETFs that use debt and derivatives to create supercharged returns... assuming, that is, everything goes as planned.

Follow the Money

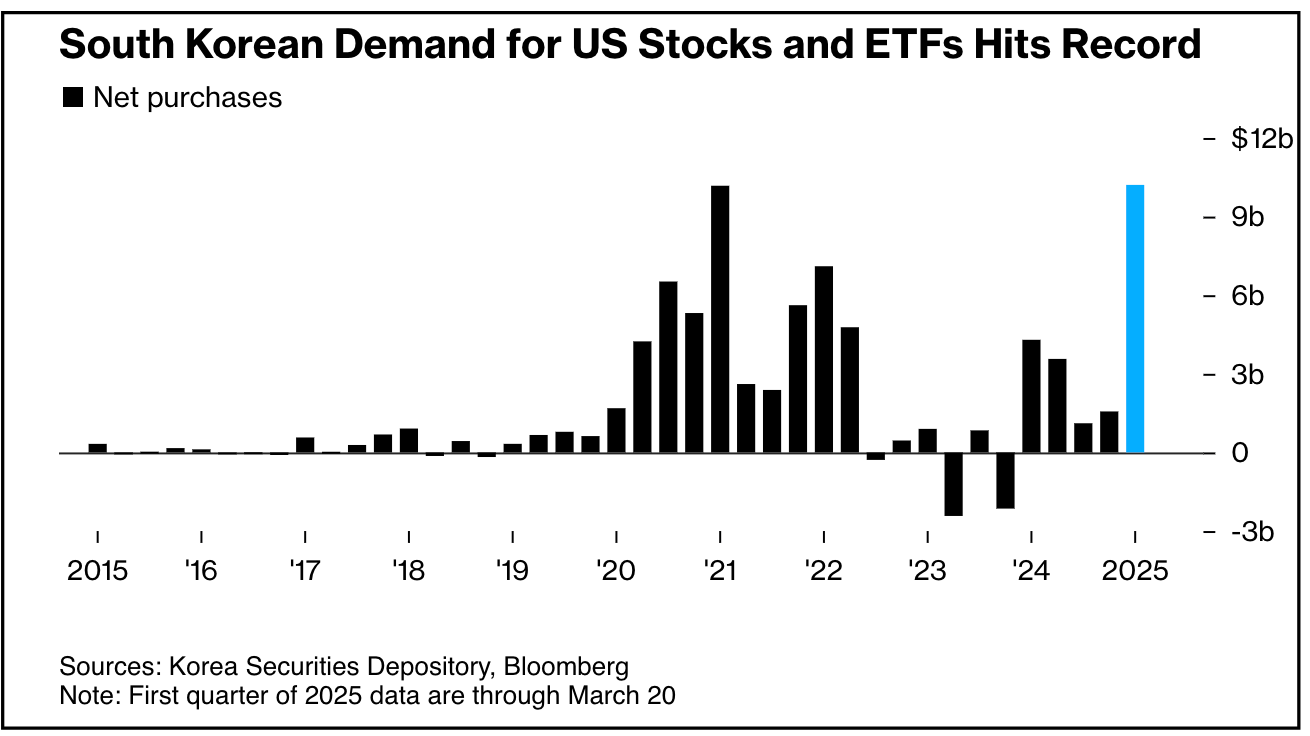

Enter this chart from a Bloomberg story about Korean investors buying U.S. stocks...

So… it’s the Koreans?

As it turns out, the Korean influence on U.S. stocks is something Acadian Asset Management researcher and portfolio manager Owen Lamont has been suggesting since January 2024, when he wrote...

Unfortunately, in recent years the U.S. has been following Korea on the road to crazytown. What Americans call ‘meme stocks,’ Koreans call ‘theme stocks.’ These absurd objects have been a wacky feature of the Korean stock market since at least 2007.

In a more recent post, headlined, “The Squid Game Stock Market,” he took it to the next level, writing...

Something’s happening in the U.S. stock market. We see cult stocks and crypto stocks. We see money pouring into leveraged single-stock ETFs and crypto ETFs. And we see dramatic price moves, for example in quantum computing stocks in December 2024. What’s going on?

Here’s one theory: these phenomena partly reflect an influx of Korean retail investors into the U.S. stock market.

After citing a few studies, he goes on to make it clear that their likely ‘wealth-destroying behavior’ won’t be ‘because they are Korean, but because they are retail.’

Lamont added...

What are they buying right now? Here’s my summary of their top-50 net buys so far in 2025:

AI, quantum computing, and robotics

Nuclear power and other data center plays

Crypto

Every market has an iconic group of retail investors who, like George Costanza, exemplify bad decisions leading to wealth destruction. In 1929, it was ‘the little fellow’ buying high leverage investment trusts traded on the NYSE. In 1989, it was Japanese salarymen speculating on land and stocks. In 1999, it was mutual fund investors buying growth funds. In 2021, it was Robinhood investors buying meme stocks. Today, perhaps that group is Korean retail investors.

All of which goes into the bucket: If it looks like and sounds like...!

The Trump Wild Card

One thing that feeds right into all of this, especially the speculative nature of things, is the next Trump tweet or executive order.

Whether you are long or short stocks these days, the one wild card is what the President will do or say next.

No matter how right you may think you are on the fundamentals, investors are one thumb away from something that wasn’t anywhere near the realm of whatever risk/reward probability calculator factored into the mix.

Any investment is always subject to true “surprises,” which by their very nature are totally unexpected. But the Trump tweets and executive orders take it to a new level...

Nuclear Gone Wild... Again!

A classic is the recent rise in nuclear stocks – reminiscent of the moves that led to my Nuclear Gone Wild report late last year. I avoided formally red-flagging them because they were simply just too speculative.

But after Oklo’s latest earnings call, I couldn’t resist. Having just added it to my Red Flag Alert Focus List, this latest surge caught my attention.

The most recent nuclear reaction in its shares is tied to the two-day rumor of an announcement after Friday’s close, of an executive order regarding nuclear power. Oklo is hoping to commercialize its version of a small modular reactor. The company’s CEO was at the signing, which shouldn’t be surprising since one of its former directors, Chris Wright, resigned from Oklo’s board to become U.S. Energy Secretary.

Beyond that implied goal to make nuclear great again, demanding an 18-month deadline for new reactor approvals, there was nothing that would cause me to change a word in what I’ve written.

Oh, and don’t forget: As is often the case with upstart public pure-plays, there is considerably more going on with well-financed private competitors – and those part of larger companies – that spend more time running their businesses than hyping themselves. With SMRs alone, there are dozens of active potential players you have never heard of, as well as some you have, such as Westinghouse and GE-Hitachi.

Now, It’s Time to Put Up...

Until Oklo and the others have working commercial reactors, they remain “story” stocks, with little more than the hope and hype of their stories having happy endings.

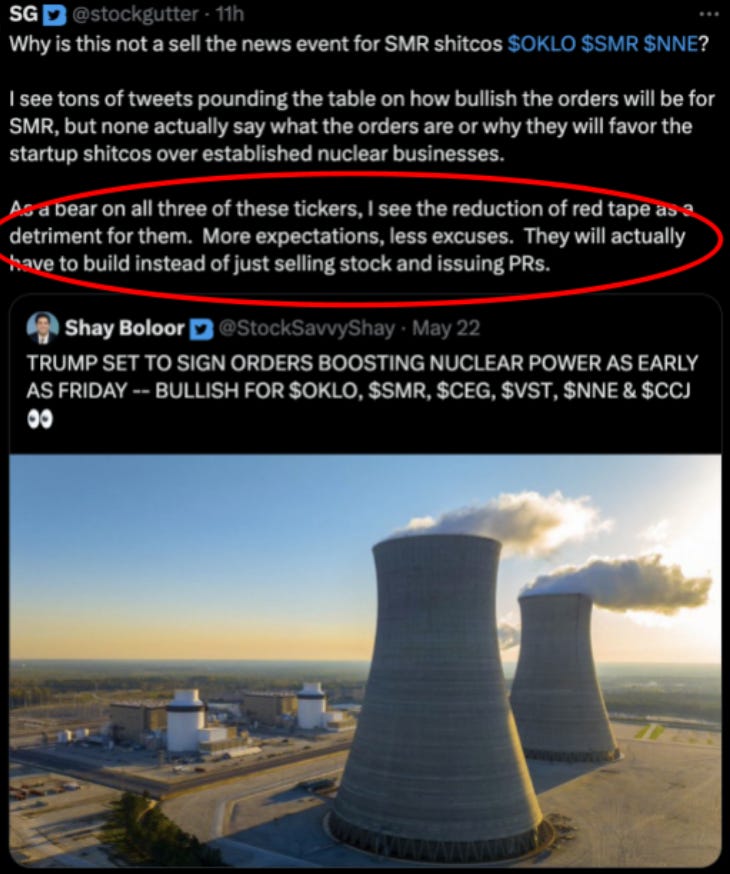

With companies as speculative as these, if they do, it won’t likely be for years. What’s clear is that at some point they’ll have to deliver. This tweet possibly says it best...

That goes for any speculative company that has never made a dime and trades on air... and then starts making money. Suddenly it has to meet expectations.

Same thing here... once Oklo and the others get approval, they have to start putting up the numbers.

From here to there the risk remains high. So does the likelihood of high volatility.

As always, interpret at will.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I have no positions in any stocks mentioned here. I’m under no obligation to update or alert subscribers if an when I make changes to any of my holdings.

Feel free to contact me at herb@herbgreenberg.com.