Why Investors Should Tread Carefully

Also, a peek back at the performance of my long-biased newsletter if the stocks had been held until today.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, please contact me directly.

Today was one of those “if it’s not nailed down it’s flying” days… especially some of the most dubious of the dubious.

But you know the old saying in the short-selling community: the markets can stay irrational more than you can stay liquid.

Especially, arguably, in this market – meaning a market with a structure that is unquestionably different than it was 20 or even 10 years ago. Pick your poison – passive flows, stocks picked by algorithms, the supposed impact of so-called “pod shops”, all of the above, none of the above. Doesn’t really matter…

While l think we all can agree that long term the markets go higher, at these levels is a giant game of chicken on when it will correct… and then how deep the correction will be and how it will last.

On the Street and Red Flag Alerts is a reader-supported newsletter that highlights the risks of investing so you don’t get hoodwinked. Whether you’re interested in individual stocks or just trying to learn about why someone is betting against you, consider becoming a premium subscriber today.

What I Do Know Is This…

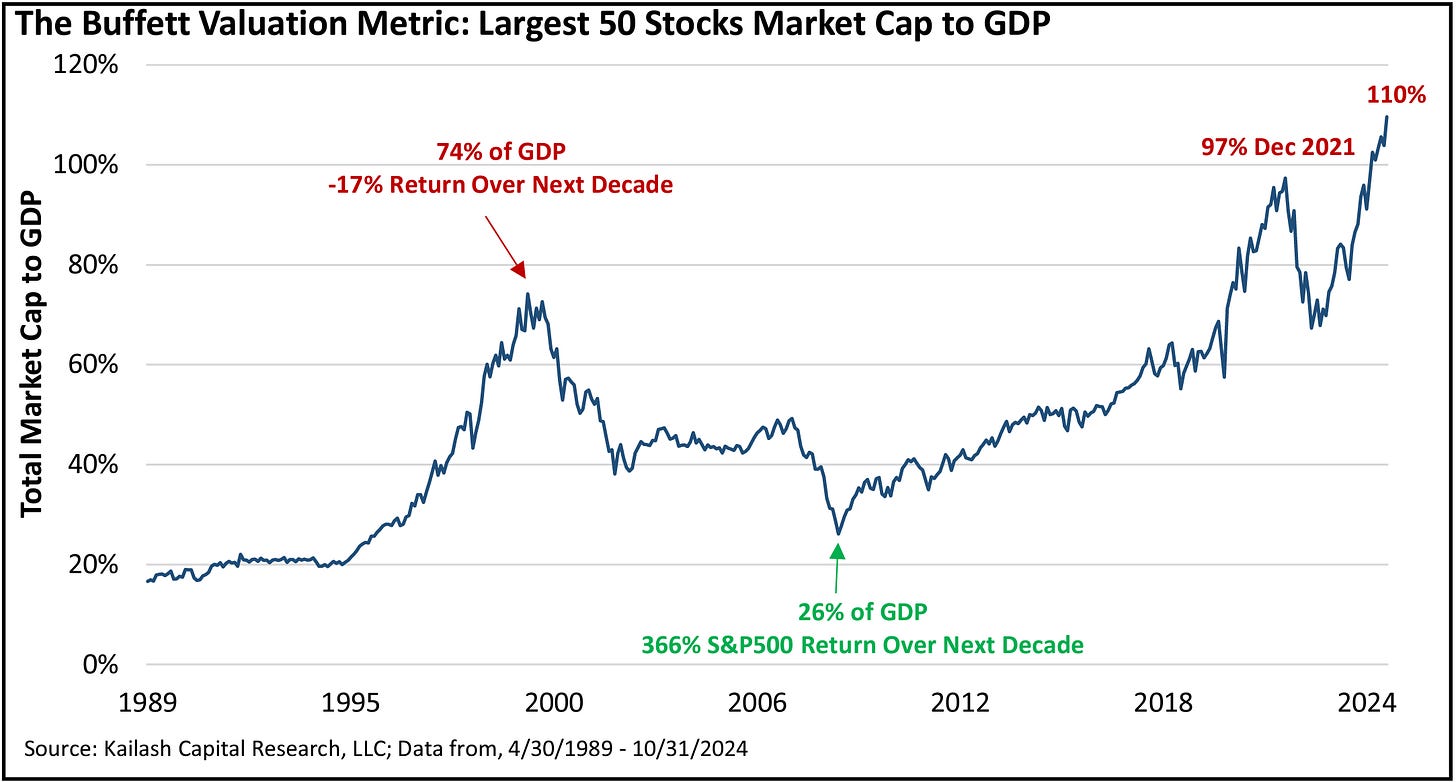

If ever there was a fear/greed indicator that should scare the living daylights out of you it should be this chart from my friends at Kailash Concepts….

As Kailash said in its report, which I urge you to read…

Others are welcome to continue fighting with arithmetic truths, but we are not. The data is unforgiving.

The story is the same with this chart, which shows the market cap of the 50 largest stocks to the GDP.

Never mind the Magnificent 7, which account for roughly one-third of the S&P 500’s valuation…. and have driven most of their gains.

These 50 stocks – let’s call them the new Nifty Fifty – account for nearly half the entire market. Or as Kailash puts it…

Out of 5,166 stocks, America’s 50 largest companies now account for nearly half the market’s total valuation – a record.

What’s It All Mean?

There are still a bunch of stocks and concepts off everybody’s radar, such as a few of Kailash’s faves…

“Blue chip consumer staples stocks like Kimberly Clark …. that have not looked this cheap since the peak of the dot.com bubble”…

Or “the much maligned and forgotten world of value stocks – many that are actually growing faster than their growth peers”…

Or “the completely forgotten compounding power of temporarily forgotten midcap stocks that frequently offer the financial stability of much more mature large-cap stocks while still having vast growth runways.”

In other words, for those of you who aren’t in it merely for “the trade,” there’s still value in this market… if you know where to look. And of course, have patience.

Speaking of Which…

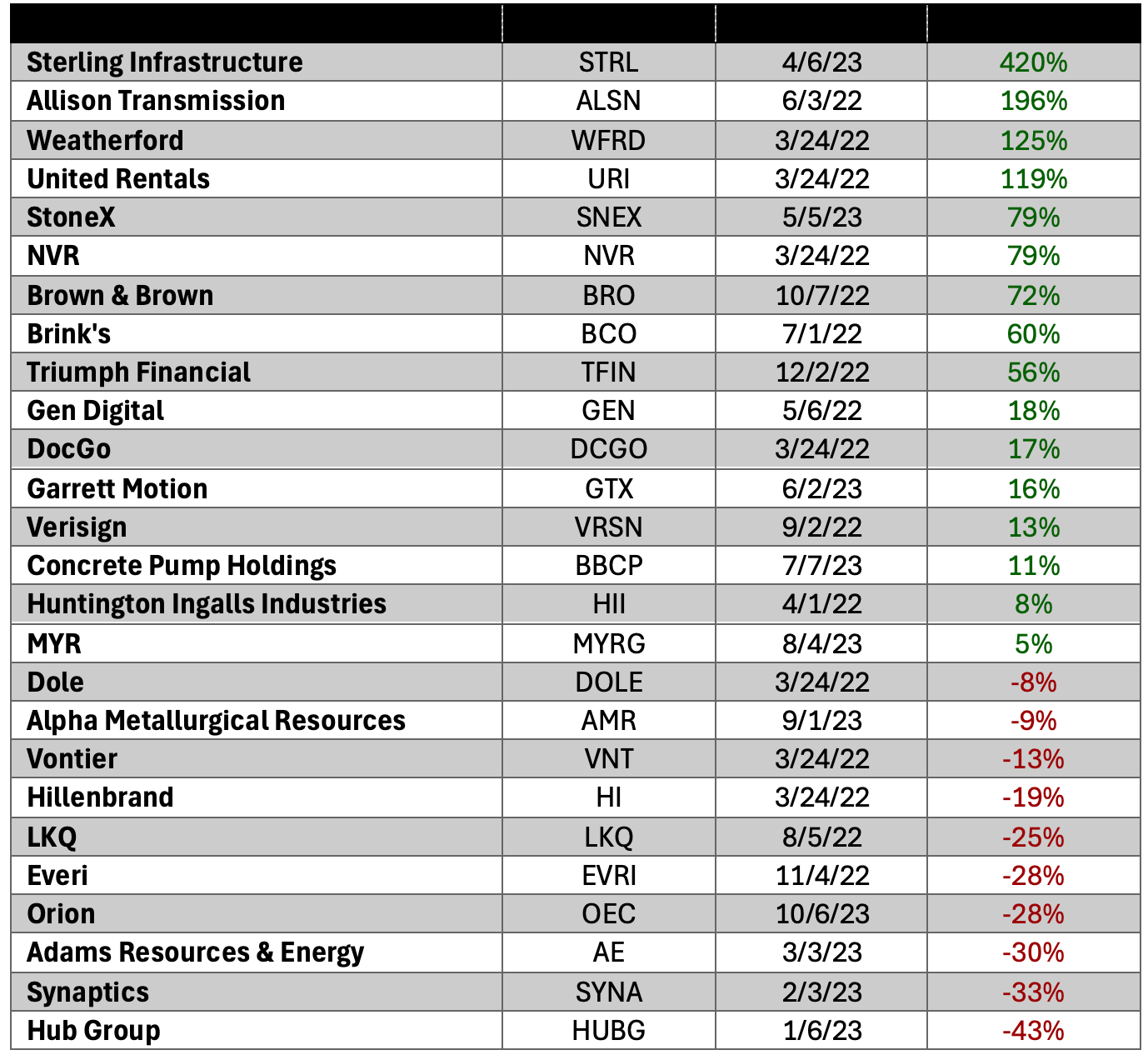

I love flying red flags, because trust me – they do and will matter. But I’ve done my share of green flags, too. You can find quite a few in my archives here, but I also did a long-biased newsletter a few years ago for the now-defunct Empire Financial Research, which was part of the Stansberry organization.

I started my first newsletter there at the worst possible time – just as the market was being rocked. I joked that by joining them I top-ticked the market. And… I did!

But my subscribers wound up the winners, assuming they held on to those I recommended.

Here’s the list…

Some of you might notice that DocGo DCGO 0.00%↑ was on the list. That was a SPAC that wound up there for reasons I’ll explain over a drink.

But long story very short; There was something about it I liked. But also something about it that made me queasy. (Being a SPAC from that era was only one of the reasons.)

Still, on the list it went in my first batch of picks. But in my monthly updates, I pretty quickly started raising my own red flags to my subscribers about “my concerns” before ultimately kicking it off the list while it was still in the green. The CEO had made a few comments on an earnings call that crossed my line.

It was no surprise, then, that a year or so later it became a hot name in short-selling circles.

And for the record: Thankfully, also in that Day One batch was Weatherford WFRD 0.00%↑, which at the time was the best turnaround story nobody believed in. (Except my colleague Gabe, who had followed the company and the oil services industry for years.)

As For the Worst Performers…

There was a lot to like about Hub Group HUBG 0.00%↑, but it was the wrong idea for the wrong time given the economy and the overall implosion of all things trucking. But it was a fun report to research and write … and I hope to resurrect it at some point here.

Ditto Synaptics SYNA 0.00%↑, which I should really brush up on. It’s the most boring of boring chip companies that was caught in an inventory overload that continued far longer than anybody had expected. (Memo to me: Time to take a second look.)

I ought also take another look at Hillenbrand HI 0.00%↑. If you’re reading this, I bet you’re thinking: “They’re the casket company, right?” Wrong. They were in the casket business. They’ve been trying to bury that part of their legacy for a few years… since spinning off what had been its cash cow.

P.S.: If you liked this, please feel free to click the heart and share this free report with friends.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in stocks mentioned in ths report.

Feel free to contact me at herb@herbgreenberg.com.

Always fun with Brian!

Hi Herb . I see what you did there with Hillenbrand burying the casket business. I always look forward to your writings, but miss you on Last Call with Sully!