Why Red Flags STILL Fly Over Signet

The company can't seem to make up its mind on which metric is most important... or makes it look best.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make. You can find out more and how to subscribe right here.

I’ve been raising red flags over Signet since my original “Sounding the Siren” on Signet since last April.

I co-authored that with my friend and sometimes collaborator, ex-short-seller Katherine Spurlock, who knows Signet better than most.

She has continued sharing her analysis with me, including most recently on December 8, when I quoted her as saying, “Lab grown diamonds are kryptonite to SIG.”

She’s back, this time sharing the kind of analysis on Signet I promise you won’t find anywhere else.

The Setup…

If you’re new to the story, Signet bills itself as the world's largest retailer of diamond jewelry. It has roughly 2,700 locations that operate under such brands as Kay, Zales, Jared and Blue Nile.

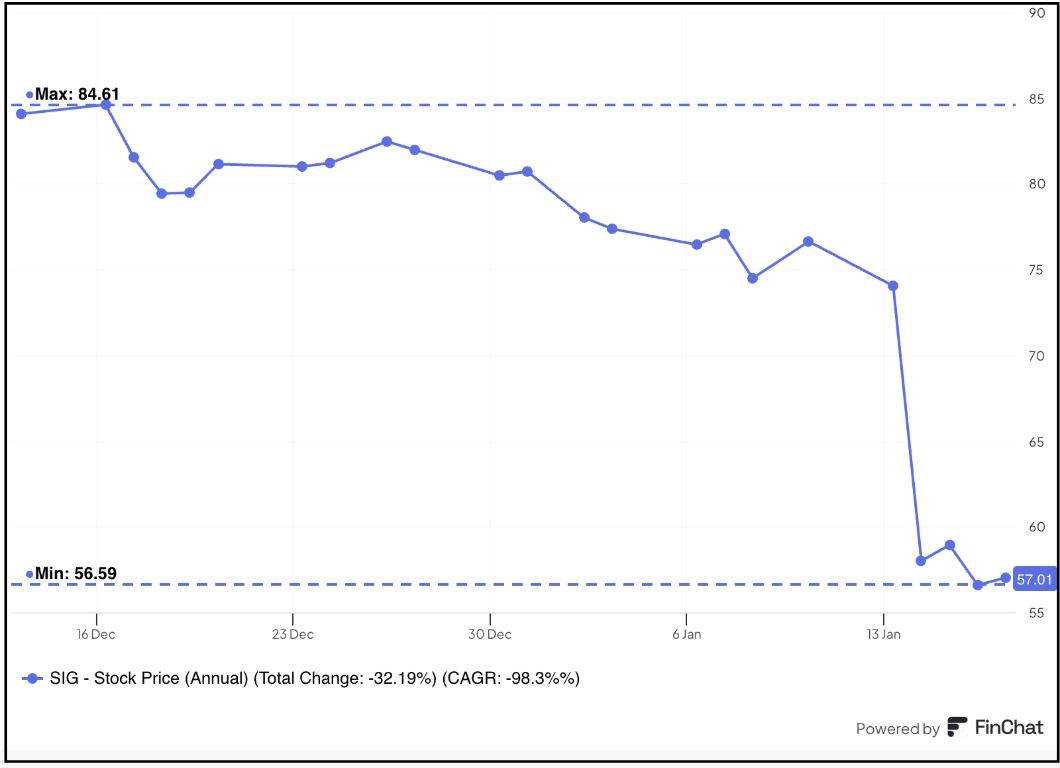

Its stock got pummeled this week after slicing its Q4 sales, profits and same-store sales guidance.

Already reeling from poor results a quarter ago, the stock plunged to new 52-week lows, leading some investors to wonder: could it possibly go any lower?

The answer is yes, and here’s why…