Why This Stock Might be a Good Long (For a Trade... and More!)

Yeah, sometimes I do green flags. This one is a timely wild card trade with a turnaround as a backstop.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

From the “yes, I do green flags every now and then” department…

We live in a world of two-second news cycles, with stocks moving so fast that people forget what just happened - why they went up, down or whatever.

That’s why after having their moment in the spotlight, the reason for the stock-jarring event is often forgotten.

But that doesn’t mean the opportunity is gone….

Which gets me to this company, which has a market value of nearly $800 million, average daily volume of nearly $10 million, revenue of nearly $700 million, negative revenue growth that is rapidly improving and a much improved balance sheet. Much of this is the result of a new CEO a year ago, which was followed by the arrival of an activist who felt the stock could more than double over 12-18 months.

The Windup…

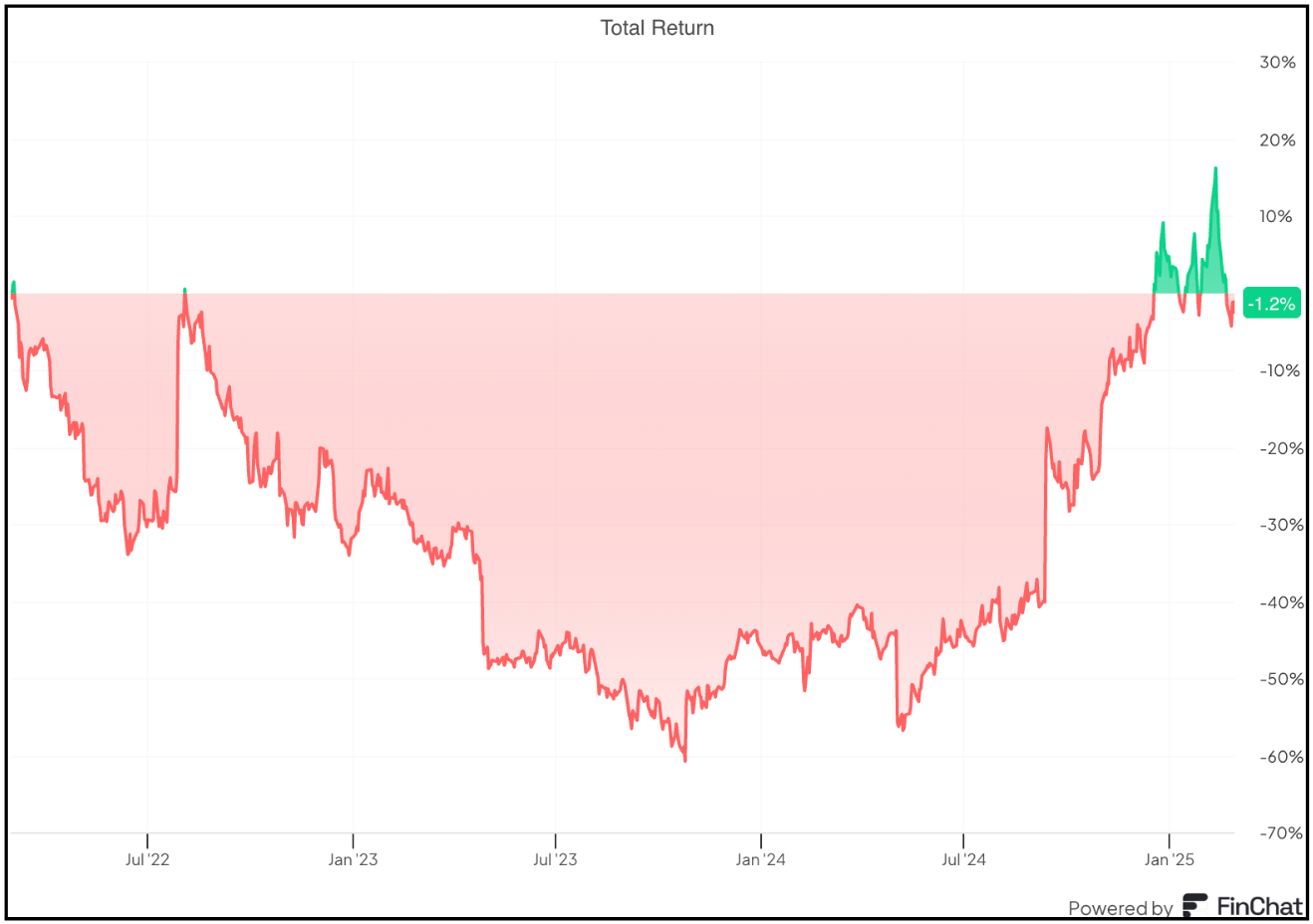

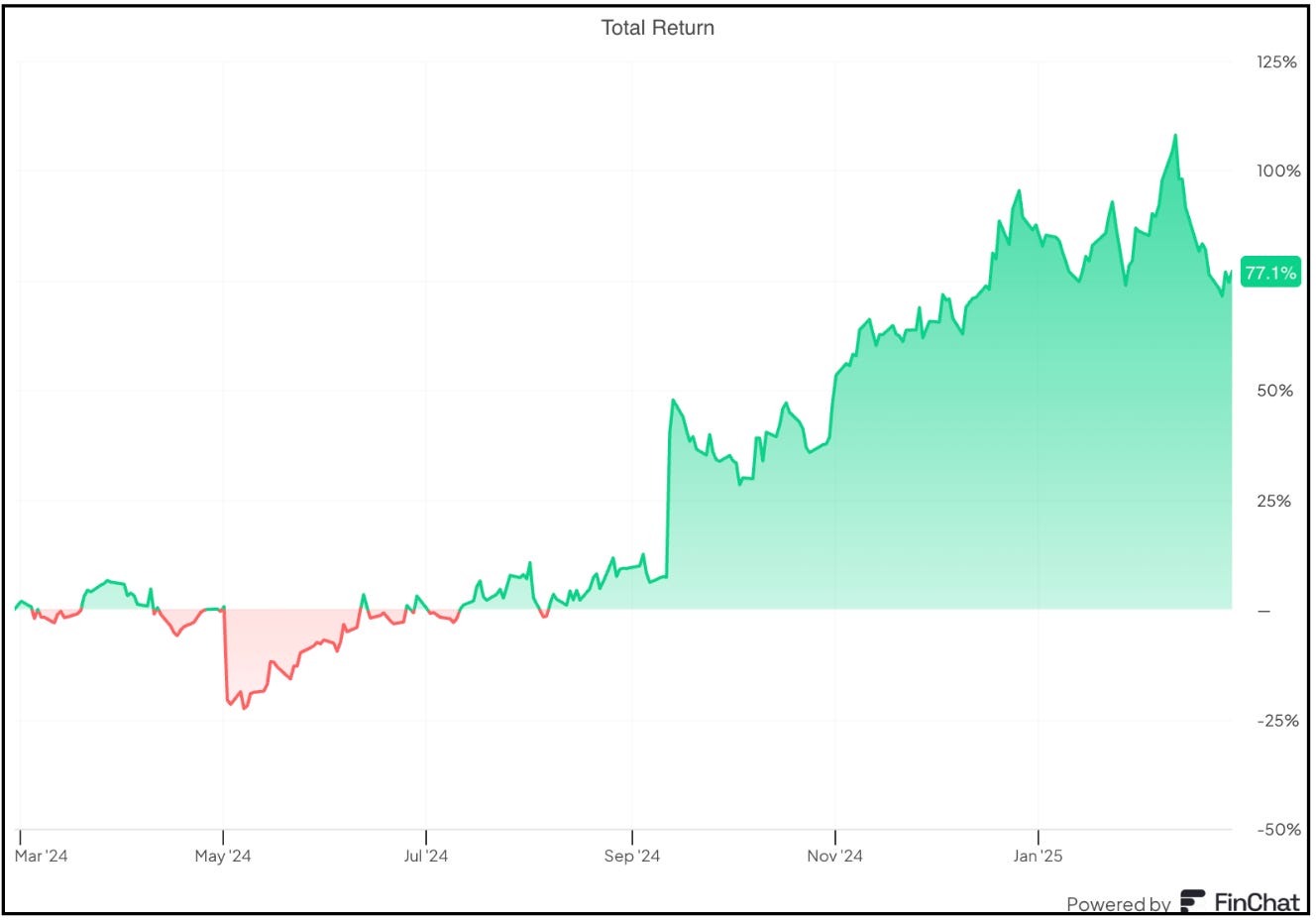

Here is the change company’s stock over the past year…

And for perspective, three years…

The “trade” part of the story, if it turns out to have legs, is tied to a potentially significant catalyst. That part of the story originally started getting traction in mid-December, and was reinvigorated again in January with news stories and additional chatter. The news cycle has since passed it by, but the issues haven’t gone away.

If the reason behind the trade portion of this story doesn’t materialize, there’s still the turnaround of the business itself, which is in the process of happening.

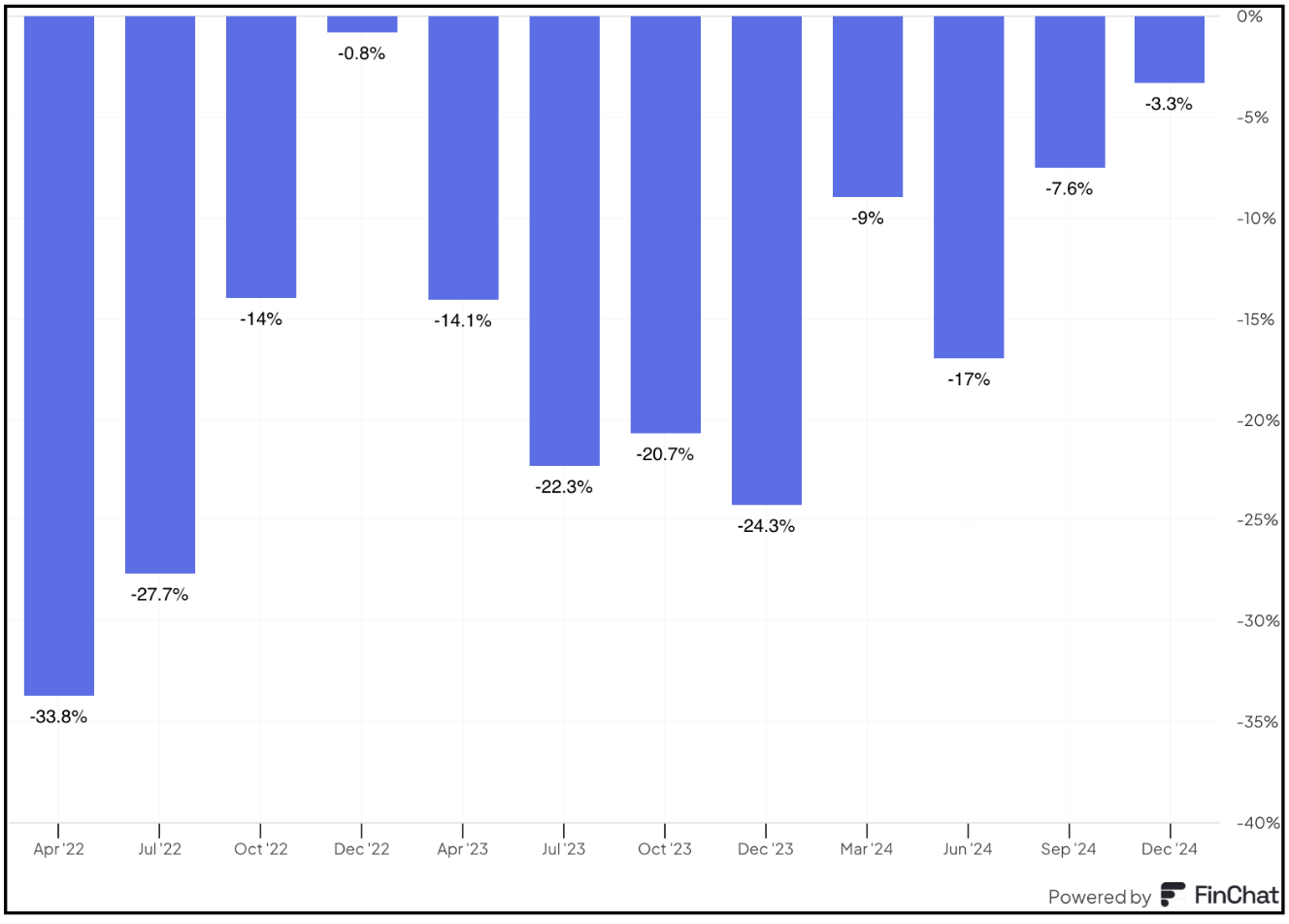

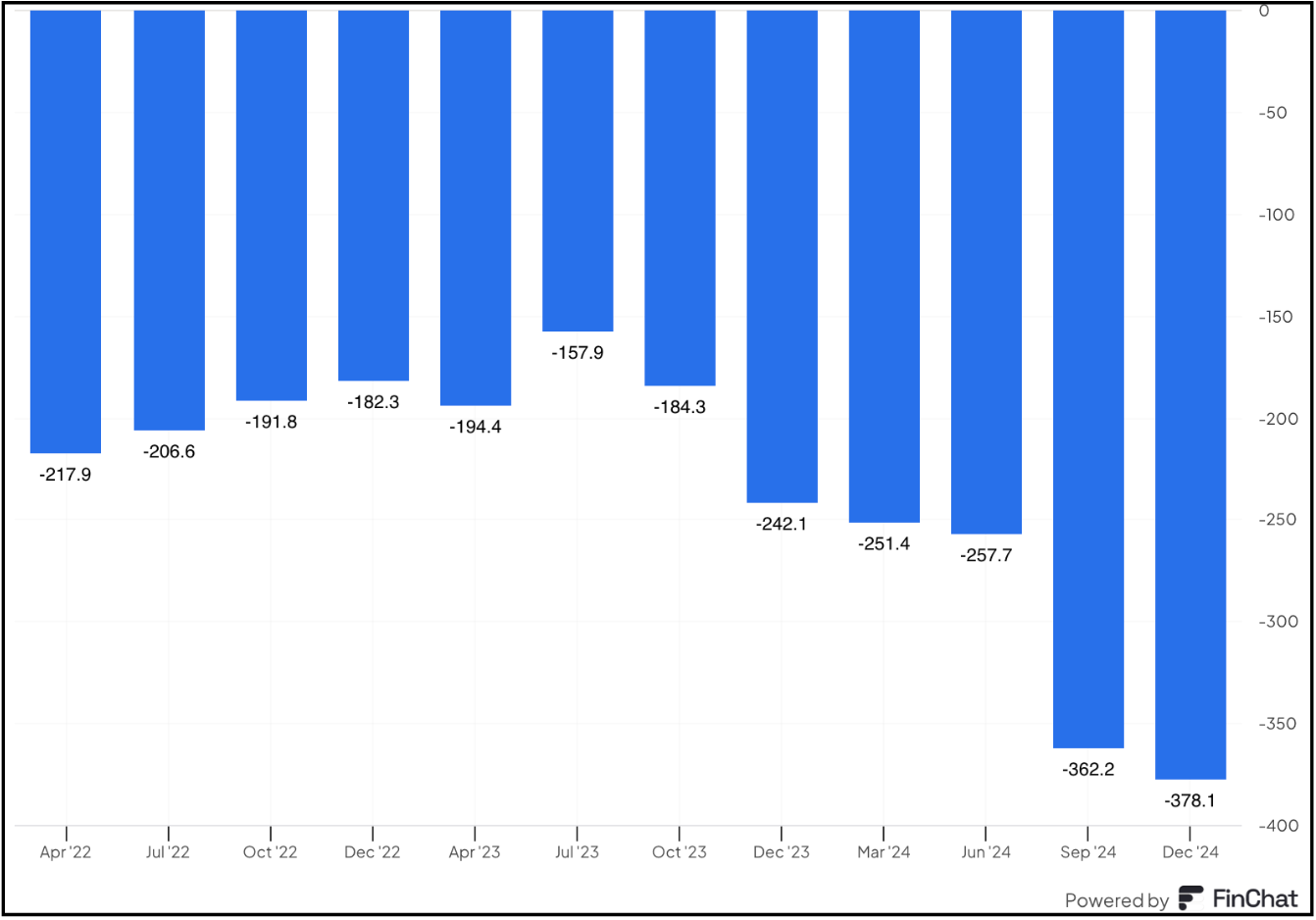

That turnaround can be seen clearly in the numbers, such as revenue growth – or lack, thereof. While still negative, the chart below shows what has happened since the new CEO took over and almost immediately did two kitchen sink quarters of write-offs that set up the company for easy comps and a good first half.

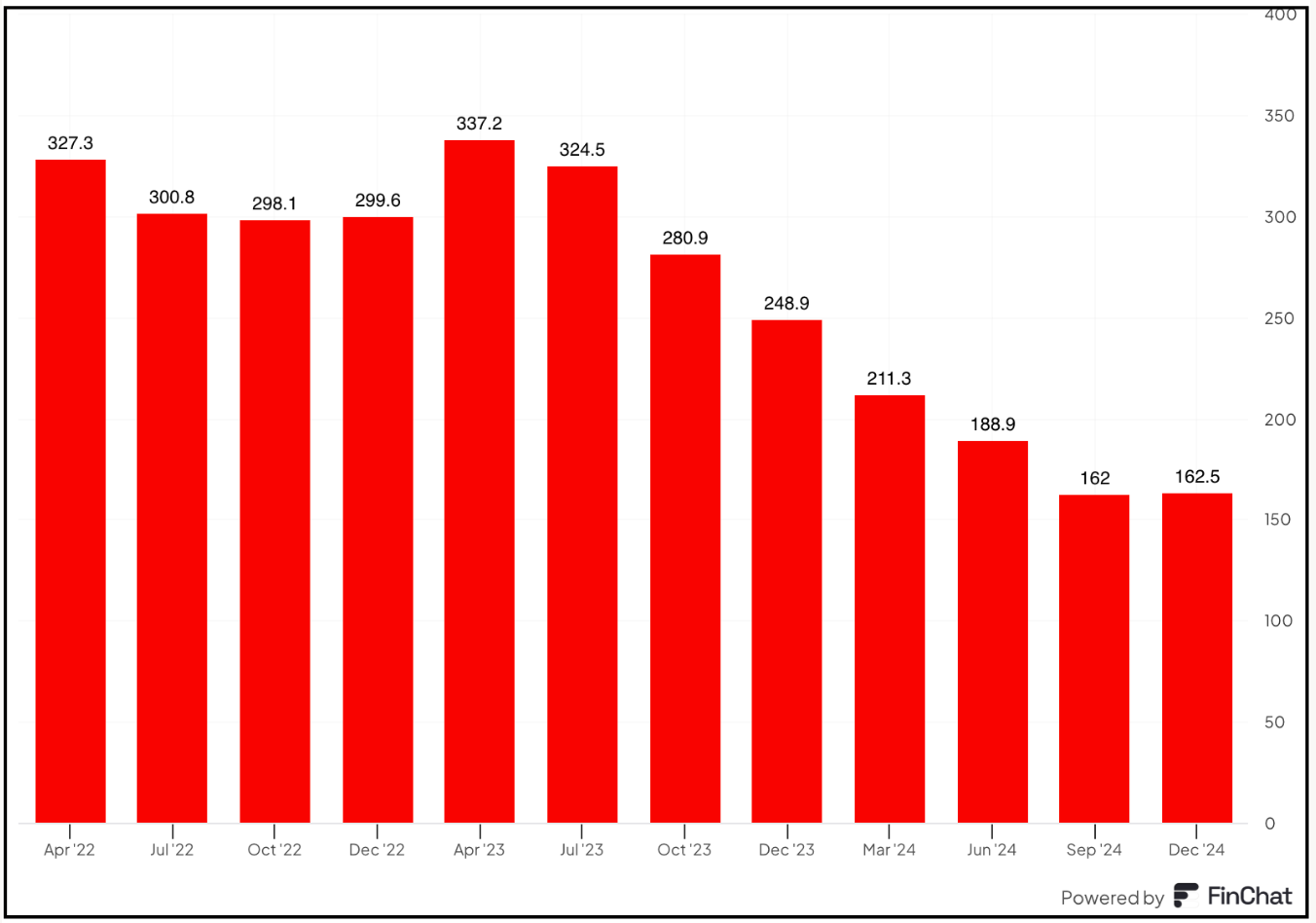

The inventory channel, which was beyond stuffed, has been cleaned out and is improving…

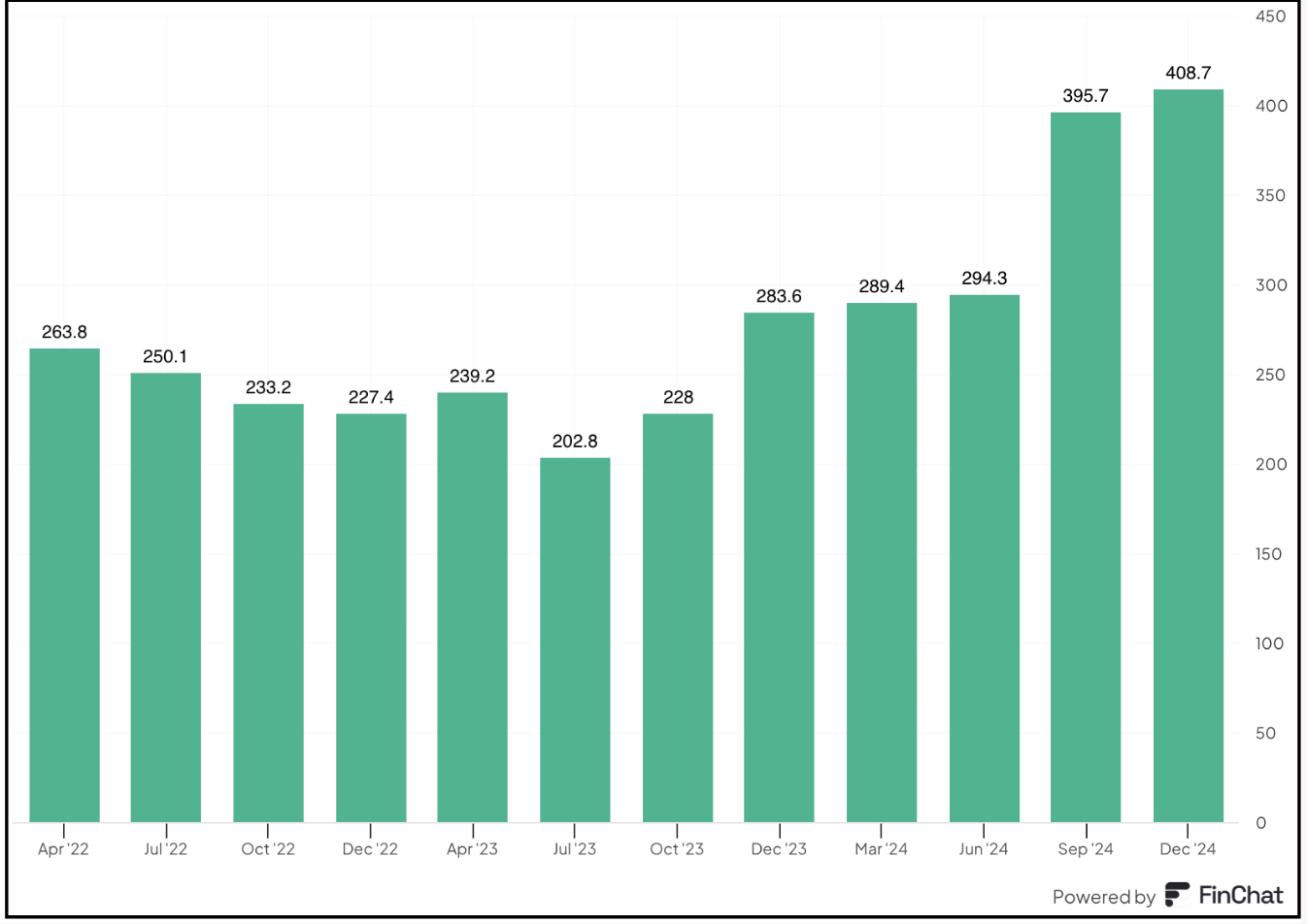

Oh, and it’s gushing cash, much of which is tied to a cash payment from winning a significant patent lawsuit…

And that can be seen in net debt…

Oh, and the name? This is a boring old company most everybody knows, but nobody thinks or talks much much about this days…