Why Tupperware's Party Was Bound to End

What Happens When a Great Brand Has an Outdated, Broken Business Model

Note: This is a free and revised version of something I originally published on May 27 of last year.

I’ve been following and red-flagging Tupperware for years, going back to my days of short-biased research. Now that the company has filed Chapter 11 bankruptcy, and its ultimate sale, I thought it was worth re-running this “case study,” as I like to call it.

And this reminder: My Red Flag Alerts and selected On the Street content are no longer free. But while the paint is still drying on my paywall, my introductory price remains. Here’s more on my decision to go paid, and what to expect from my Red Flag Alerts. Next Tupperware, anyone?

Just because a brand is great, doesn't mean it's a good investment...

The most compelling example today is Tupperware Brands TUP 0.00%↑ , which is no stranger to my longtime readers… and likely no stranger to anybody.

It’s a tale worthy of being told and retold, and a lesson that should never be forgotten.

Hold the Confetti

When I last wrote about Tupperware, in August of last year, in a piece headlined, “Hold the Confetti,” the stock had just spiked 50% after the company reached a deal with its banks to restructure its debt. As i wrote at the time…

Even with this restructuring, Tupperware’s stock remains highly speculative…

Terms of the credit agreement include provisions for bankruptcy and default, and including wording in the event shares no longer actively trade on the New York Stock Exchange… or anywhere.

As usual, investors ignored the warning, and the shares lifted even higher, almost like a meme stock, because after all, this was Tupperware.

Regulatory Filing From Hell

But what many investors must’ve missed, was the regulatory filing back in April of last year when Tupperware said there was substantial doubt it could continue as a going concern – that is, whether it can even manage to stay afloat.

I would call this the regulatory filing from hell… every company’s worst nightmare.

The company said it wasn’t in compliance with New York Stock Exchange listing standards and that was "doing everything in its power to mitigate the impacts of recent events" – including seeking additional funding. (Famous last words.)

Tupperware also warned that it would likely be in violation of loan covenants, and reminded everybody that less than a month earlier it had disclosed that its financial statements from 2020, 2021 and the first three quarters of 2022 “were materially misstated and therefore the financial statements should be restated and no longer relied upon.”

The Crazy Thing Is…

This was the very same company whose board just a few months earlier had authorized a $75 million stock buyback. The reason, its CEO said, was its confidence "in our early outlook of the year."

Never mind that it didn't have the cash flow or balance sheet to do one.

(File this one away as yet another reason why you should always run – not walk – from financially hobbled companies that announce buybacks as a sign of confidence. In reality, the mere announcement is usually a sign of desperation. But I digress…)

This was all just the latest in the ongoing saga of Tupperware, whose business model despite the iconic nature of its brand has been broken for years...

As I’ve written numerous times, the days of Tupperware parties have passed it by... not just in the U.S., but across the globe.

On Its Death Bed

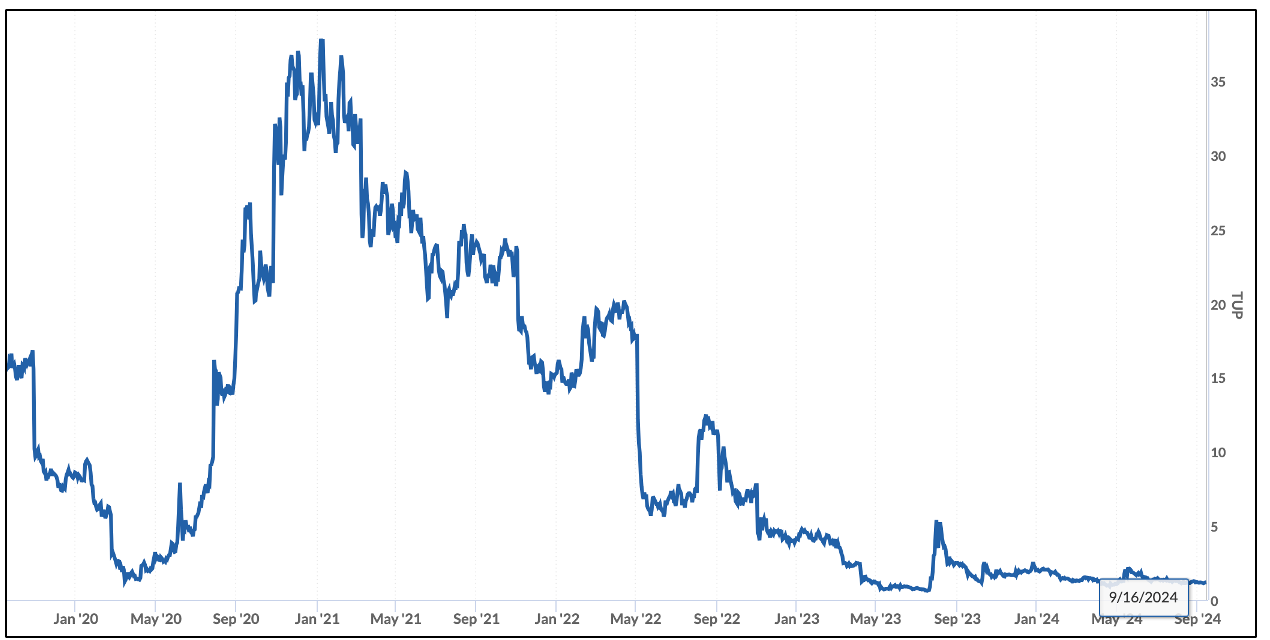

What many people don’t remember was that in early 2020, just before the pandemic hit, Tupperware appeared to be on its death bed. Its stock had sunk to levels not quite as low as it is today, before skyrocketing seemingly overnight.

Tupperware swiftly became a COVID winner as people started cooking more at home, causing them to seek out containers for leftovers… and Tupperware parties shifted to Zoom.

Before long, its stock rose nearly 3,000%, before plunging back to earth.

The Trouble was, Tupperware was trying to sell via parties and a creaky multi-level-marketing business model while facing increased competition at retail from the likes of Newell Brands' NWL 0.00%↑ Rubbermaid, Clorox's CLX 0.00%↑ Glad, and Helen of Troy's HELE 0.00%↑ Oxo brand, among many others that are cheaper and more readily available.

But for a direct seller like Tupperware, even more worrisome: beyond the competition of selling products there was also competition for salespeople. That was especially tough in the "gig economy,” given the rise of companies like Uber UBER 0.00%↑, DoorDash DASH 0.00%↑, and Lyft LYFT 0.00%↑, but also continued competition from other direct sellers... including the Pampered Chef, Perfectly Posh, and Stella and Dot.

Perennial Turnaround

What’s more, the company had been desperately trying to turn itself around for years...

As part of doing so, it has started to turn to retail, currently most recently via Target TGT 0.00%↑ but also Amazon AMZN 0.00%↑. This marks the second time in 20 years it has tried to sell through Target... in a sense, creating another layer of competition for itself. After one quarter, management says that Target amounts to around a mere 1% of sales.

Adding to the challenge is the downside of having a brand that has become generic. By that, I mean if you go to Target's website and type in "Tupperware," it spits out products not limited to Tupperware, but also competitors that even include Target's own house brand.

Just Another Brand

One of the trickiest parts of investing is determining if a product is a brand or a business, or worse, a fad...

Tupperware clearly isn't a fad, but it has devolved into a brand that in all likelihood shouldn't be a company. The story is in the numbers...

As of last year, Tupperware's sales had plunged by half from its 2013 highs. The company’s gross margin has been shrinking. While management has said it's pulling out all stops to protect it, that’s like plugging leaks in a dam. And it doesn't really matter, because the company is barely making money and its free cash flow has turned negative.

Which Gets Us to Today

The reality is, just because Tupperware is a great brand doesn't mean things can't get worse.

Wall Street is littered with the remains of great brands whose companies didn't survive...

Among them, Blackberry, Kodak, Polaroid, Blockbuster, Toys "R" Us, Palm, America Online, and Xerox, to name a few...

That's not to say all companies that are either given up for dead or deemed fads disappear. Great examples include Crocs CROX 0.00%↑ , Apple AAPL 0.00%↑ , Netflix NFLX 0.00%↑, Monster Beverage MNST 0.00%↑, Starbucks SBUX 0.00%↑, and Chipotle Mexican Grill CMG 0.00%↑.

As for Tupperware, I'm sure the brand will survive, but doing so as a public company? Given that the company appears to be filing for bankruptcy, even if it reorganizes, that seems like a long shot.

If you liked this, please click the heart below!

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in this stock.

I can be reached at herb@herbgreenberg.com.